Monthly Market Commentary – April ’22

-Darren Leavitt, CFA

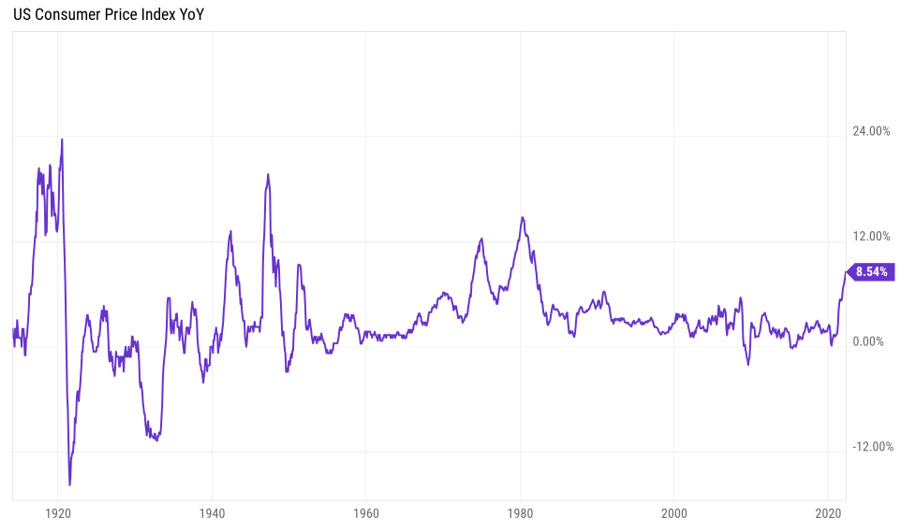

Global financial markets had a rough month in April. Inflation continued to be top of mind for investors as data continued to show historic increases in prices. The Federal Reserve still appears to be behind the curve in combating inflation, but throughout the month, Fed officials provided multiple indications that more action would be taken. The more hawkish rhetoric took a toll on the yield curve, which saw massive swings over the month. The headwind of higher interest rates also continued to hit global equities. The S&P 500 could not hold critical areas of technical support, which left the index vulnerable to a late-month sell-off. Q1 earnings started with mixed results and were on the margin disappointing for the mega-cap leadership names, i.e., Apple, Google, Facebook, Amazon, and Microsoft.

China’s zero Covid policy continued to wreak havoc on the global supply chain as major factories shut down. China did respond with more monetary stimulus and a pullback on its most recent regulatory crackdown. The Russian and Ukraine war continued without a resolution, contributing to global inflation woes. Russian atrocities against Ukraine induced more sanctions and invoked international calls for more military and humanitarian aid.

Economic data showed inflation running hot in multiple data series. Data also showed a slowdown in manufacturing and services while the labor market continued to be tight. Interestingly, sentiment indicators and retail sales have held up nicely.

The S&P 500 lost 9.11%, the Dow gave back 5.29%, the NASDAQ decreased by 13.51%, and the Russell 2000 shed 10.86%. International developed markets lost 7.61%, while emerging markets pulled back 7.67%. Technically, the S&P 500 became vulnerable to more losses as the index broke down below its 200-day moving average of 4495 and then through the support of its 50-day moving average of 4418. Currently, the market looks oversold, and many contra indicators suggest we could see a bounce.

The yield curve was all over the place in April. We started the month with an inverted curve where the 2-10 spread went negative. The inversion was short-lived, and then we saw the 2-10 spread expand back to 38 basis points only to have it compress again. For the month, the 2-year yield increased forty-one basis points to 2.69%, while the 10-year yield increased by fifty-six basis points to close at 2.89%. It is widely accepted that the Fed will raise its policy rate by 50 basis points in the May meeting and start to normalize its balance sheet by $95 billion a month.

Oil was one of the only assets to gain in the month. Oil prices increased 4.5% or $4.60 to close at $105.03 a barrel. Gold prices fell 2.1% or $41.70 to $1911.30 an Oz. Copper prices fell 7% or $0.34 to $4.41 an lb. The dollar continued its strength against other majors. The $/Yen climbed north of 130, the lowest level since 2002. The Euro/$ fell to 1.0565, the lowest level since 2016.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.