Weekly Market Commentary 2/26/2021

-Darren Leavitt, CFA

A continued steepening of the yield curve induced selling of all asset classes throughout the week. Economic growth expectations have stoked inflation fears, sending the 10-year note yield fifty-two basis points higher over the month. Federal Reserve Chairman Jerome Powell tried to damper inflation fears in his bi-annual testimony in front of Congress by reiterating his opinion that the Fed’s inflation mandate of 2% will likely take 3-years to attain. The Chairman also made clear that the Fed’s monetary policies would remain accommodative for the next few years and that their $120 billion per month of asset purchases would continue as well. The testimony helped lift markets off their lows on both Tuesday and Wednesday but failed in curbing losses for the week.

The S&P 500 sank 2.4% for the week while the Dow shed 1.8%. The NASDAQ led declines with a loss of 4.9%, and the Russell gave up 2.9%. The 2-year note yield gained three basis points to close at 0.14%, and the 10-year yield, which traded as high as 1.61%, ended the week up eleven basis points at 1.46%. Safe-haven gold lost nearly 3% or $48.80 to close at $1728.40 an Oz, which is somewhat surprising given the precious metals’ psychological hedge on inflation. Similarly, Bitcoin’s perceived hedge against inflation was questioned as the cryptocurrency price fell from 58k to 42K over the week. Oil continued to trade higher, with WTI gaining 4% on the week or $2.30 to close at $61.45 a barrel.

The week’s initial jobless claims ticked down to 730k from the prior week’s 841k while continuing claims fell to 4.419 million. Consumer Confidence came in at 91.3, just shy of the 91.5 that was expected but up from the prior reading of 88.9. The University of Michigan’s Consumer Sentiment came in at 76.8 versus expectations of 77. January personal income came soared to 10% on a month over month basis on government social benefits. January personal spending increased 2.4%, while the savings rate increased to 20.5%. The PCE price index and Core PCE that excludes energy and food both increased by .3% or 1.5% year over year, showing tame inflation.

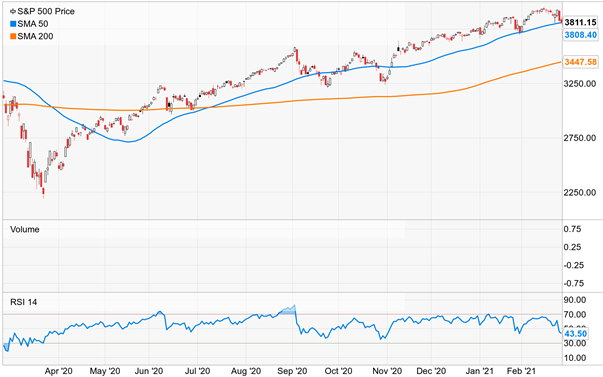

Technically the S&P 500 breached its 50-day moving average on Friday but was able to trade back and close above the level. The hold was encouraging, but traders will be watching this level for the next several sessions to see if it can hold or if another breach will bring on more selling.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.