Weekly Market Commentary -4/1/2022

-Darren Leavitt, CFA

Financial markets started the week with a strong rally on the back of what appeared to be constructive negotiations between Russia and Ukraine. However, progress was refuted as the week moved forward, and financial markets gave up most of their gains. The EU followed the US and warned China of helping Russian war efforts. China announced that it would allow Chinese companies listed in the US to provide financials to US regulators. The announcement helped to lift Chinese ADRs. Global economic data continued to show hotter than expected inflation and a slight tick down in manufacturing and services.

The S&P 500 gained 0.1%, the Dow gave back 0.1%, the NASDAQ rose by 0.7%, and the Russell 2000 added 0.6%. Real Estate and Utilities led while Financials and Energy lagged. The 2-10 spread inverted, which some believe is a harbinger of recession. The 2-year yield increased by fourteen basis points to 2.43%, while the 10year yield decreased by eleven basis points to 2.38%. Oil prices fell 14.5% or $14.29 to close at $99.54 a barrel. The Biden administration announced that it would release 1 million barrels a day from the Strategic Petroleum Reserve-an unprecedented move that saw several other developed nations follow suit. OPEC+ also announced that it would increase production by 32000 barrels a day to 432,000. Gold prices fell 1.3% or $27.30 to 1925.60 an Oz. Copper prices were unchanged on the week closing at 4.69 a Lb. Bitcoins rose by ~$2000 t $46,383.

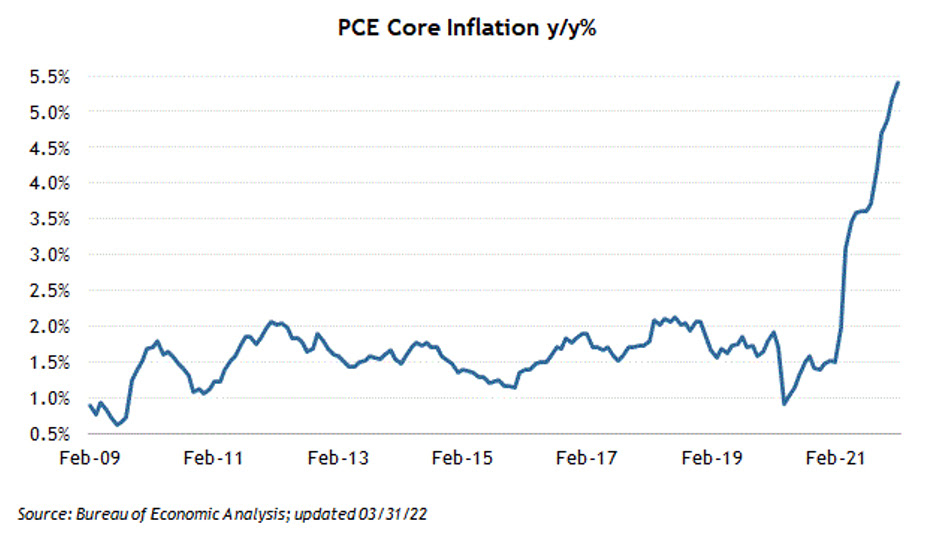

Another strong Employment Situation Report highlighted economic data. Non-Farm Payrolls increased by 431K while Private Payrolls increased by 426k. The unemployment rate ticked down to 3.6% from the prior reading of 3.8%. Average Hourly Earnings increased by 0.4%, which was in line with expectations and up 5.4% on a year-over-year basis. The Average Work Week came in at 34.6 versus the estimate of 34.7. Initial Claims came in at 202k, and Continuing Claims fell to 1307k. March Consumer Confidence surprised to the upside coming in at 107.2, better than the expected 106.9. The Federal Reserve’s preferred inflation measure, PCE, came in line at 0.6%, while the Core number, which excludes food and energy, came in at 0.4%. The Core reading was up 5.4% year over year and was the highest reading since 1983.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.