Weekly Market Commentary – 8/12/2022

-Darren Leavitt, CFA

Weaker than anticipated inflation data released in the second half of the week bolstered the peak inflation narrative and catalyzed the S&P 500 to the fourth week of gains. Of note, on a technical basis, the S&P 500 has now exceeded a retracement of 50% of its losses from its June 16th low of 3,666.77. BTIG Technical analyst Jonathan Krinsky noted that since 1950 a retracement greater than 50% off the lows has never gone on to make new cycle lows- so perhaps we’ve seen the worst of this bear market. The rally has induced momentum strategies back into the market, and there appears to be a real sense that there is a fear of missing out trade going on too. Earnings continue to come in mixed. Notably, NVidia and Micron disappointed with their guidance, while investors cheered solid results out of Disney. In Washington, the House approved the Inflation Reduction Act and is awaiting President Biden’s signature.

The S&P 500 gained 3.3%, the Dow added 2.9%, the NASDAQ climbed 3.1%, and the Russell 2000 led with an advance of 5%. The yield curve ended the week pretty much where it started. The 2-year note yield increased by two basis points to 3.25%, while the 10-year increased by one basis point to 2.85%. Oil prices surged on the week and reclaimed the key technical level of $92. Reports from the IEA and OPEC+ suggested oil demand would fall over the next year but also pointed out that we remain in a supply deficit. WTI prices increased by $3.61 and closed at $92.34 a barrel. Gold prices increased by 1.4% or $25 to $1815.30 an Oz. Copper prices increased by $0.11 to $3.66 an Lb. The US dollar was generally weaker against the other major currencies.

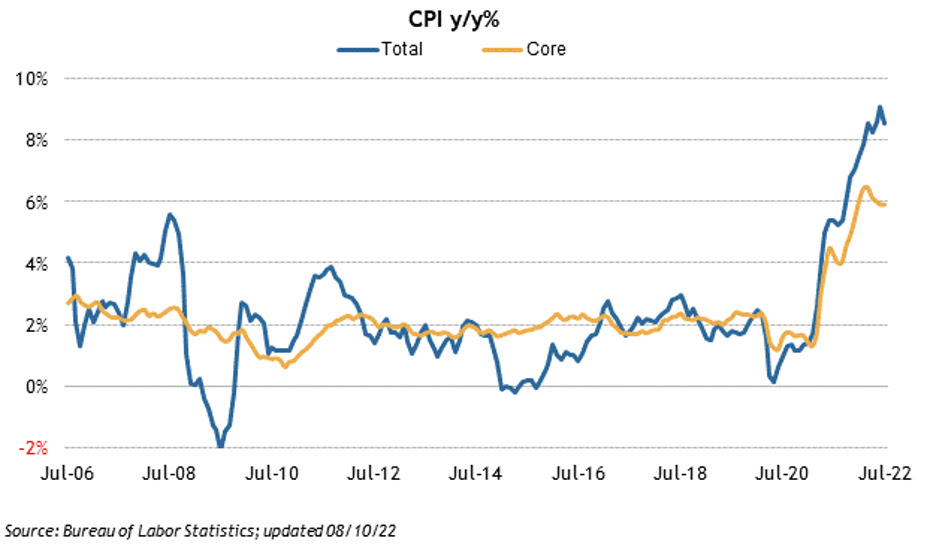

The July headline number for the Consumer Price Index (CPI) came in flat versus expectations of a 0.3% increase. The reading is up 8.5% year-over-year, down from June’s 9.1% print. The Core reading, which excludes food and energy, came in at 0.3% versus the consensus estimate of 0.6% and is up 5.9% year-over-year, in line with June’s reading. The food index was up 1.1% monthly and 10.9% over the last year. The energy index was down 4.6% month-over-month but still up 32.9% from last year. The Shelter index increased by 0.5% in July and is up 5.2% year-over-year. The Producer Price Index (PPI) also showed decreases in prices. The headline number came in at -0.5% versus the estimated 0.3%. Core PPI was up 0.2%, lower than the expected 0.4%. Import and Export prices declined as well. On the employment front, we saw Initial Claims of 262K and Continuing claims tick up to 1428k from 1420k. A preliminary reading of the University of Michigan’s Consumer Sentiment index showed a tick higher in sentiment to 55.1% from July’s final reading of 51.5%.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.