Weekly Market Commentary – 3/26/2021

-Darren Leavitt, CFA

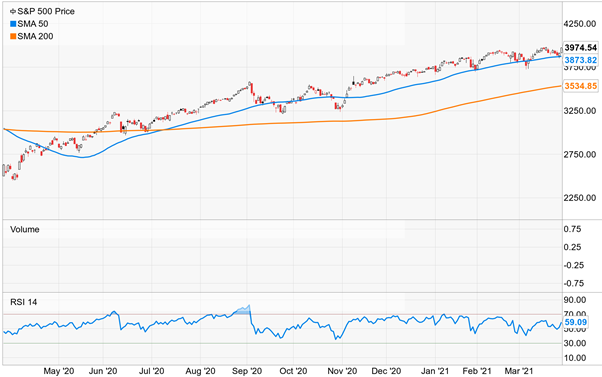

It was a mixed week on Wall Street that saw continued quarter-end rebalancing that supported pro-cyclical issues and hindered mega-cap growth issues. For the week, the S&P 500 gained 1.6%, the Dow added 1.4%, the NASDAQ declined 0.6%, and the Russell 2000 gave back 2.9%. The S&P 500 and the Russell 2000 breached their 50-day moving averages during the week. The S&P 500 was able to find support and trade above the 3873 level while the Russell struggled to regain the 2290 level. The 2-year note yield fell one basis point to 0.14%, while the 10-year yield in whipsaw trade fell seven basis points to 1.66%. Gold prices fell $9 to $1732.50 an Oz. Oil trade for the week was again quite volatile as investors ascertained the ramifications of the Suez Canal blockage on the commodity. WTI closed down $1.44 to $60.99 a barrel.

There was plenty of corporate news on the tape this week, which started with the announcement that railroad Canadian Pacific will acquire Kansas City Southern in a cash and stock deal worth $29 billion. Other corporate news included Intel’s report of a $20 billion investment in a new fabrication facility in Arizona and news that AstraZeneca’s vaccine was not as effective as initially thought.

News of extending lockdown measures in Germany and the Netherlands dampened market sentiment even as vaccination protocols in the US were broadened to include more age groups.

In Washington, President Biden held his first press conference to introduce a $4 Trillion infrastructure spending plan in the coming week. Treasury Secretary Janet Yellen and Fed Chairman Jerome Powell testified in front of Congress on the CARES act, which provided very little incremental news for investors.

Economic data for the week was better than expected. The final reading of the University of Michigan’s consumer sentiment index was the best in a year coming in at 84.9 versus expectations of 83.6. Initial jobless claims were lower by 97k to 684k, the lowest level since last March. Continuing Claims fell 264K to 3.87 million. February Personal income fell 7.1%, slightly worse than the expected decline of 7%. Personal spending came in at -1% versus the consensus estimate of -0.7%. However, interestingly the February savings rate fell to 13.6% from January’s 19.8%.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.